In July 2009, South Carolina passed its solar rebate tax incentive law to allow homeowners in the state to claim credits for any renewable energy systems that they installed in their homes.

This law provides a tax credit of up to 25 percent on all eligible costs to a maximum of $3500 or 50 percent of a person’s tax liability, whichever amount is less when applied to the individual’s yearly taxes.

This law provides a tax credit of up to 25 percent on all eligible costs to a maximum of $3500 or 50 percent of a person’s tax liability, whichever amount is less when applied to the individual’s yearly taxes.

According to solarpowerrocks.com, “You’d have to be living underground to not want solar on your SC roof… the state’s solar tax credit allows homeowners who install solar to reduce their taxes by 25% of the costs of their system, up to $3500 per year for up to 10 years.”

The incentives apply not only to the actual installation of the solar power system but also the costs for labor and materials that you incurred on or after January 1, 2006.

To claim this tax credit, your system must have been installed by an entity that is endorsed by the South Carolina Energy Office. Solar companies like Blue Raven Solar have this endorsement and can install systems that allow you to claim the state’s solar power tax incentives.

How to Claim South Carolina’s Solar Tax Credits on Your Return

You saw your friends and neighbors getting solar and you joined the revolution. The system is on your roof, and you’re seeing the power savings, but tax season is looming and you’re not sure how to proceed. Let us help with this guide to claiming your SC state tax credit.

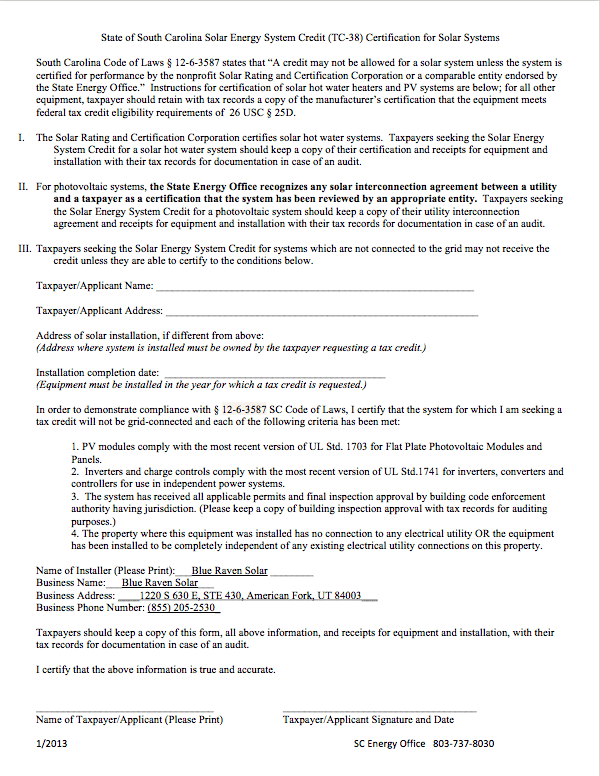

Claiming the state’s solar tax credits when you file your state return requires that you fill out and submit the proper documentation to prove that you have a solar system installed. The process of completing the paperwork itself is relatively straightforward and simple. Solar power companies like Blue Raven Solar do some of the work for you by making available forms that already have the companies’ information provided.

For Blue Raven customers, there is a quick step by step download with Blue Raven specific information here.

Gather These Documents to Get Started:

- SC Certification for PV Systems (download “Certiciation for PV Systems” under Solar)

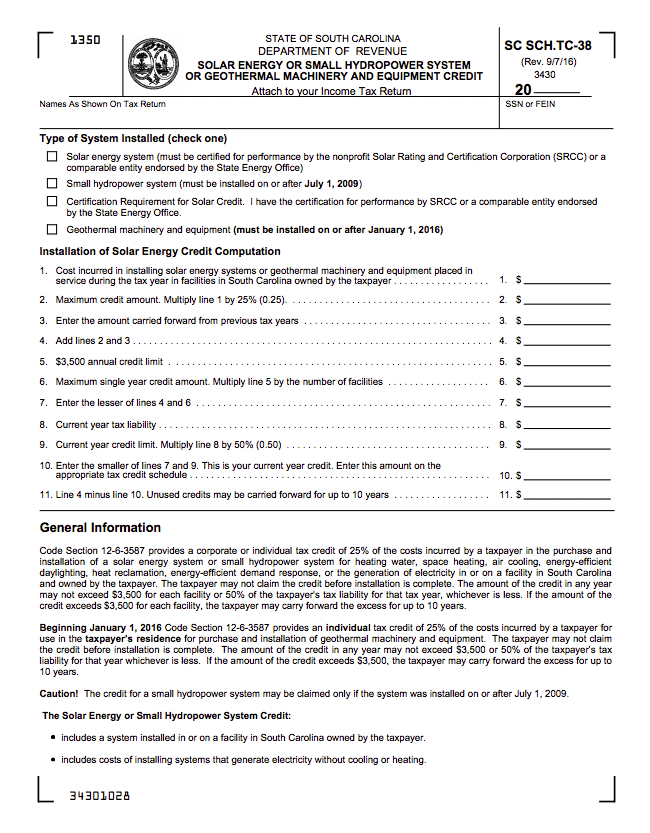

- TC-38 Tax Form (SC Dept of Revenue Solar Energy or Small Hydropower System Credit)

Step 1 – Complete & Sign System Credit (T-38) Certification

Step 1 – Complete & Sign System Credit (T-38) Certification

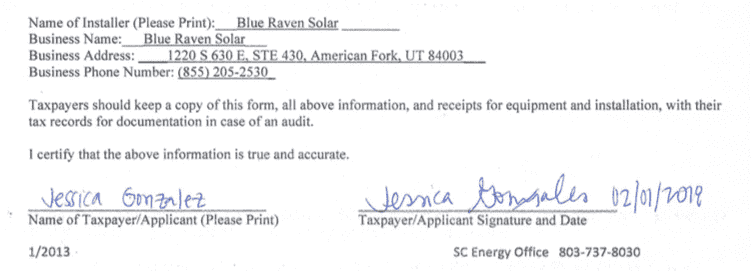

Complete and sign the State of South Carolina Solar Power System Credit (T-38) Certification for Solar Systems before submitting it with your return. Fill in the name, address and phone number of your installer. If you are a Blue Raven customer, Blue Raven Solar has already provided its information for you.

Step 2 – Print Your Name and Sign the Form

The South Carolina Solar Council, which is a non-profit entity, provides the certification that you are referencing on this form. You do not need to provide that particular information to claim the tax credit. Solar power systems that are interconnected are already deemed certified by the utility with which they are interconnected.

Step 3 – File With Tax Forms

Step 3 – File With Tax Forms

Keep this form for your records with your other tax files. This form does not need to be submitted for you credit, but you should file it with your tax forms.

Step 4 – State’s TC-38 Form

Step 4 – State’s TC-38 Form

Grab your state’s TC-38 form to claim the credit. You must submit this form with your state return to get the tax incentive.

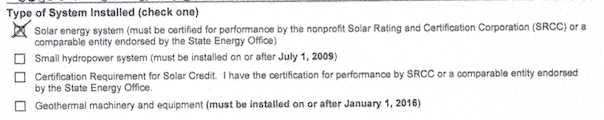

The TC-38 form itself requires that you provide identifiable details about your solar power system. Under the section for “Type of System Installed,” you should select the first box for solar power system.

Step 5 – Identify Complete the Cost of the System

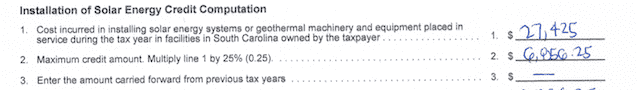

Include the full cost of what you paid for its installation under the heading for “Installation of Solar Energy Credit Computation.” On line 1. For our example, we’ll say our system cost $27,425.

If you cannot recall what you paid out of your own bank account, you should reference the invoice provided by your solar company.

Step 6 – Simple Math & Rollover Amounts

After you list the final cost of your solar panel system on Line 1, you apply the tax credit on line 2, multiplying line 1 and 25% (or .25). If your system was 27,245, you would multiply by .25 and get 6,856.25, enter it on line 2.

You’ll only use line 3 if it’s a rollover year and you are applying for an additional portion of your return (i.e. it’s not your first year claiming your tax credit and you had a balance left). Once you finish completing these lines, you can then submit the form with your state taxes.

Step 7 – Claiming Credits

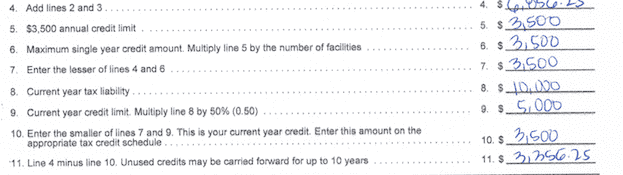

Lines 4-10 are used as a calculator for you to figure out how much you can claim this year. For many it is the full credit, but it will depend on your taxes so it will be different for everyone. Line 10 will give you the amount for your credit this year, and line 11 is the difference (if there is one). If you did have a difference, you would use the number in line 11 for next year.

Step 8 – Submit TC-38

Step 8 – Submit TC-38

Submit your TC-38 with your taxes. Send off your forms to the IRS and get the solar tax credit you deserve.

Learning More About SC Solar Power Tax Incentives

If you are thinking about installing one of these systems in your home but want to know more about what kind of tax rebates and incentives you might be entitled to, you can get most if not all of your questions answered by choosing a reliable and experienced solar power company.

Blue Raven Solar has knowledgeable staff who are familiar with the tax incentive program in South Carolina and other states. You can find out how much you might be able to recoup out of your own expenses when you file your taxes after your system is installed.

You can also get assistance with filling out the tax forms for the credits by visiting the state’s energy website at www.energy.sc.gov. You can download the necessary forms, learn more about solar power, and find other helpful resources available for taxpayers who want to take advantage of this credit. The resources are free to download and are updated with each tax season.

As solar power continues to rise in popularity, more homeowners across the U.S. want to invest in solar power. Find out more about what tax incentives you might be eligible for and how to claim them by visiting Blue Raven Solar online today.

Visit our South Carolina page to learn more as well.

Claim Your Federal Tax Credit

![]()

![]()

![]()

Do You Have More Questions?

We’re here to help!

CONTACT BLUE RAVEN SOLAR FOR MORE INFO ON SOLAR TAX SAVINGS! 844-594-2333

*Disclaimer: Please remember we are a solar company, not a tax company. We aren’t giving tax advice, but simply want to give you a bit of an idea of how your claim might work for your solar incentive. If you’re looking for tax advice, we’d recommend you consult a tax professional before you file.

Sorry, the comment form is closed at this time.